Bitcoin ETFs in the US drive higher crypto allocations among institutional investors

Institutional investors increasingly sought exposure to crypto during the first quarter of the year following the launch of several US-based spot Bitcoin exchange-traded funds (ETFs) in January.

The CoinShares Digital Fund Manager survey revealed that these institutional investors have significantly increased their digital asset allocations, reaching 3% in their portfolios. This marks the highest level since the survey’s inception in 2021.

Many of these investors attributed their increased exposure to digital asset investments to distributed ledger technology.

Additionally, they now perceive digital assets as offering good value and an increased demand for investing in BTC as a diversifier.

Bitcoin shows the most compelling growth outlook.

Institutional investors’ portfolios predominantly feature Bitcoin, the premier digital asset in demand among this cohort. According to James Butterfill, head of research at CoinShares, over a quarter of these respondents said their portfolios had exposure to BTC via the spot ETFs.

Following Bitcoin, Ethereum holds the second position, although investor interest has declined since the previous survey.

According to investors, BTC and ETH remain the digital assets with the most compelling growth outlook.

Nevertheless, Solana has seen a surge in investor enthusiasm, evidenced by an uptick in its allocation to 14%. This increase is primarily driven by a select group of significant investors expanding their holdings in the fast-rising blockchain network, which has enjoyed rapid growth in price and adoption over the past year.

While other alternative digital assets have struggled, XRP stands out for its considerable decline. None of the surveyed investors mentioned holding it.

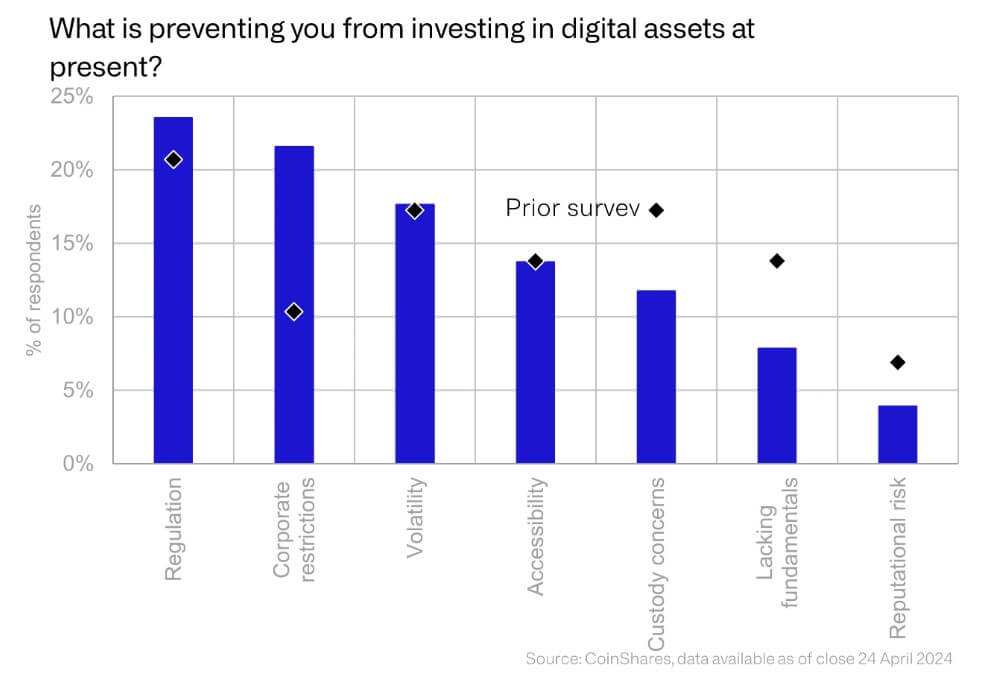

Investment barriers

Despite the growing exposure to digital assets and the advent of Bitcoin ETFs, many investors still struggle to access this asset class.

The CoinShares survey showed that regulatory concerns remain the foremost barrier for most investors. The emerging industry faces regulatory scrutiny, particularly in the US, where financial regulators like the SEC have filed several legal actions against major players like Binance and Coinbase.

Meanwhile, the inherent volatility of the emerging sector continues to be a significant concern for some investors. However, custody issues, reputation risk, and the absence of a fundamental investment case are becoming less problematic.

Mentioned in this article

Comments are closed, but trackbacks and pingbacks are open.