Bitcoin transaction fees surge to make up 75% of miner revenue post-halving

Bitcoin’s fourth halving introduced a long-term and a short-term shift in miner revenue composition as it reduced the amount of BTC rewarded to miners for each mined block by 50% — directly impacting miner incentives and, by extension, the broader Bitcoin economy.

On April 19, just before the halving, transaction fees constituted 11% of total miner revenue, a figure that has been relatively stable throughout the year. However, the halving event on April 20 caused a substantial change, with transaction fees skyrocketing to over 75% of miner revenue.

The surge in fees can be attributed to a combination of factors. Firstly, a significant part of the market might have raced to settle their transactions before the halving, which has driven up transaction fees.

Secondly, there seemed to be a growing demand for transactions, and users wanted to be included in the halving block itself. Most of this demand could be attributed to Ordinals, as inscriptions on the coveted block 840,000 could be worth more on the secondary market.

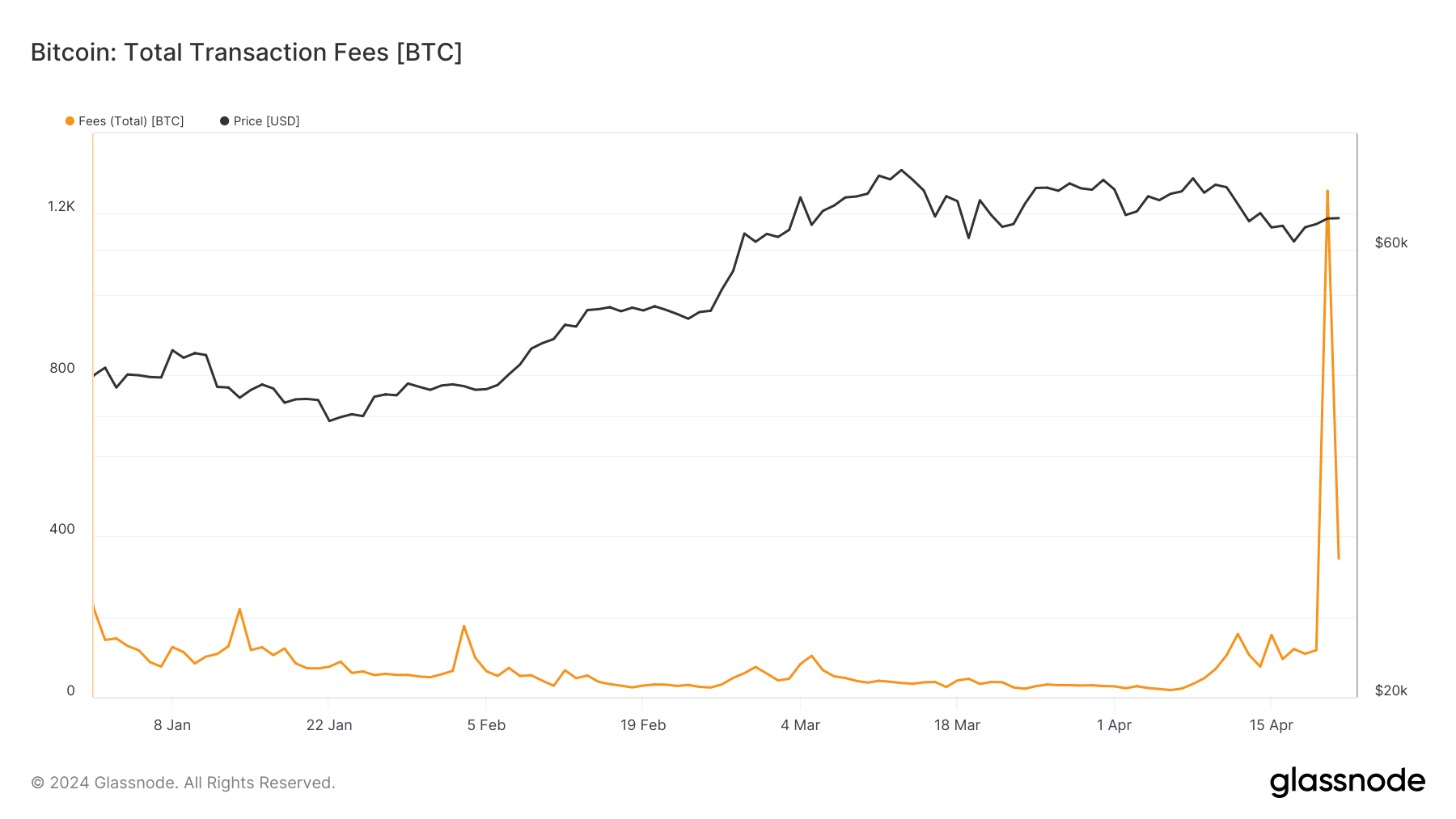

This demand for limited block space drove transaction fees to historic highs, which paid 1,257 BTC to miners on the day of the halving. On April 19, the day before the halving, the total fees paid to miners were 116 BTC, showing just how dramatic the escalation in transaction cost was.

The subsequent drop to 344 BTC in fees on April 21, while still significantly higher than pre-halving levels, shows the market normalized and began to adjust to the new mining economics.

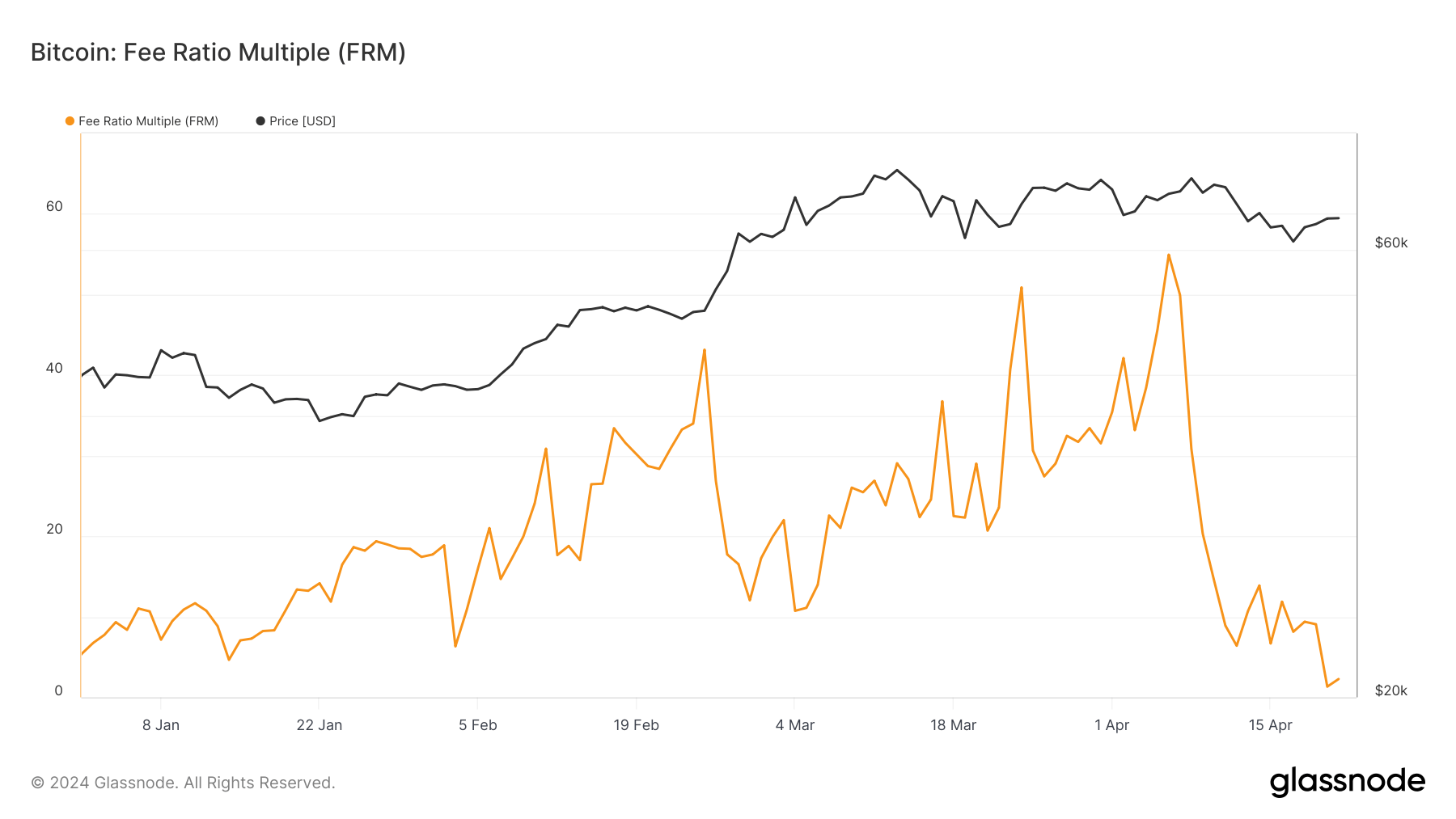

The Fee Ratio Multiple (FRM) clearly shows the impact of these heightened fees. The metric is used to evaluate the economic security of a blockchain, particularly as it transitions from block reward-based miner compensation to one predominated by transaction fees. The FRM is calculated by dividing the total miner revenue, consisting of block rewards and transaction fees, with the transaction fees.

This metric helps assess how much of the mining income is derived from transaction fees rather than block rewards, offering insights into the blockchain’s sustainability once block rewards are no longer a significant factor.

On April 19, the day before the halving, the FRM stood at 9.01. It indicates that the total miner revenue was approximately nine times the amount earned from transaction fees alone, with the majority of miner income still heavily reliant on block rewards.

As the block reward was reduced in half and the transaction fees increased, the FRM dropped to 1.325, showing just how dramatic the shift towards reliance on fees was. With the block reward reduced, transaction fees comprised a much larger proportion of the total miner revenue, decreasing the FRM value.

A lower FRM value implies that the blockchain is moving closer to a state where it could theoretically sustain itself predominantly on transaction fees. This is crucial for its long-term security and viability as block rewards continue to halve until they cease.

However, this could negatively affect a large part of the network. As transaction fees begin to constitute a larger portion of miner revenue, the cost to users may increase, potentially affecting how transactions are prioritized and impacting user behavior. This could lead to even higher fee spikes during peak demand.

The post Bitcoin transaction fees surge to make up 75% of miner revenue post-halving appeared first on CryptoSlate.

Comments are closed, but trackbacks and pingbacks are open.