Ethereum whales face liquidation risk as ETH prices fluctuate

Key Takeaways

- Two Ethereum whales risk forced liquidations due to declining ETH prices.

- A combined total of 125,603 ETH on the Maker protocol could be liquidated if price thresholds are breached.

Share this article

Ethereum’s price fluctuations have placed whales on MakerDAO in a vulnerable position, with a combined 125,603 ETH worth around $238 million at risk of liquidation.

Data tracked by blockchain analytics platform Lookonchain shows that one whale, controlling around 64,793 ETH, is close to its liquidation price of $1,787.

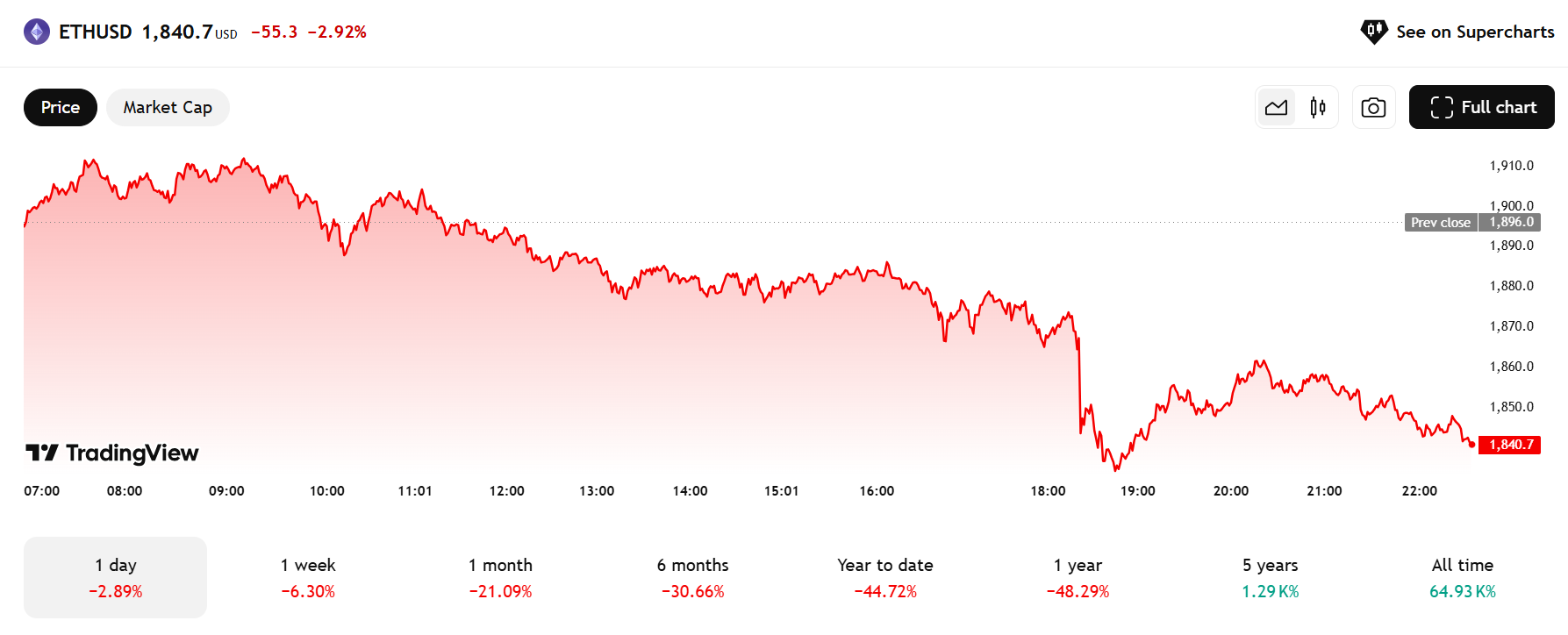

With ETH trading at $1,841 at press time, this whale is only $54 away from its liquidation price.

The trader narrowly avoided liquidation on March 11 by partially repaying their debt after a sharp ETH price drop.

However, the current downturn has put their position back in jeopardy, with the health rate now at 1.04. Continued price decreases could trigger automatic liquidation.

Another whale deposited 60,810 ETH as collateral to borrow 75.69 million DAI, with a liquidation threshold of $1,805. The position faces automatic liquidation if ETH prices fall below this level.

ETH dips below $1,900 amid ETF drag, hacker dump, and market slump

Ethereum has fallen below $1,900, registering a 6% decrease in the past seven days amid market-wide turbulence. Apart from that, a series of negative catalysts have weighed heavily on crypto’s price.

Rising inflation fears and disappointing US economic data have led investors to reduce exposure to risk assets, including crypto assets. President Trump’s announcement of reciprocal tariffs set to take effect on April 2 has further heightened market uncertainty.

Bitcoin briefly dipped below $82,000 in early Saturday trading before recovering slightly to $82,800.

Currently, BTC is trading around $82,400, reflecting a nearly 2% decline over the past week, according to TradingView data. The Bitcoin pullback is also dragging down altcoins, including Ethereum.

On the ETF market, US-listed spot Ethereum funds showed continued sluggish performance.

According to Farside Investors’ data, between March 5 and March 27, investors pulled over $400 million from these funds. The trend reversed yesterday as the ETFs collectively drew in nearly $5.

While the slow uptake has dampened investor enthusiasm, there’s anticipation that the potential enabling of the staking feature could help boost ETF demand. A number of ETF managers are seeking SEC approval to add staking to their existing spot Ethereum ETFs.

Another factor potentially influencing ETH’s price is the sell-off triggered by a hacker dumping a large amount of stolen Ethereum.

According to an early report from Lookonchain, hackers recently offloaded 14,064 Ethereum from THORChain and Chainflip.

Hackers are dumping $ETH!

2 new wallets(likely related to hackers) received 14,064 $ETH from #THORChain and #Chainflip, then dumped for 27.5M $DAI at an average selling price of $1,956.https://t.co/hSP1PRGpuLhttps://t.co/6axvL6d7Dg pic.twitter.com/7RoYCGMdWD

— Lookonchain (@lookonchain) March 28, 2025

Share this article

Comments are closed, but trackbacks and pingbacks are open.