XRP’s Consolidation Ends, Bull Rally Imminent?

On October 15, 2024, Ripple’s native token XRP broke out of its prolonged consolidation zone and is poised for a massive upside rally. For nearly two weeks, XRP had been trading within a narrow range. During this period, whales and institutions significantly acquired XRP tokens following the filing of its Spot Exchange Traded Fund (ETF) in the United States.

XRP Current Price Momentum

At press time, XRP is trading near $0.548 and has experienced a price surge of over 3.6% in the past 24 hours. During the same period, its trading volume increased by 90%, indicating heightened participation from traders and investors following the consolidation breakout.

XRP Technical Analysis and Upcoming Level

According to CoinPedia’s technical analysis, XRP appears bullish and is currently facing resistance at the 200-day Exponential Moving Average (EMA). Despite the breakout from the prolonged consolidation zone, XRP is likely to struggle until it breaches the 200 EMA and closes the daily candle above it.

Based on the recent price performance, if XRP closes a daily candle above the $0.5580 level, there is a strong possibility it could soar by 17% to reach the $0.65 level or higher if sentiment remains positive. XRP’s Relative Strength Index (RSI) is currently in the oversold area which suggests a potential price reversal in the coming days.

Bullish On-Chain Metrics

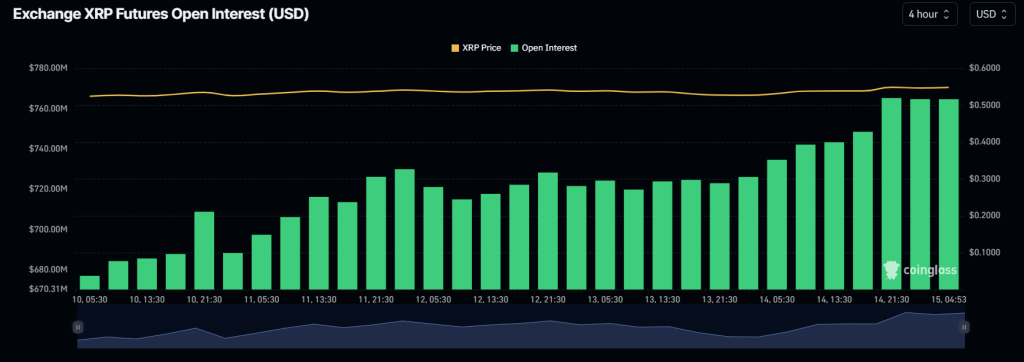

XRP’s bullish outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, XRP’s Long/Short ratio currently stands at 1.039, indicating strong bullish sentiment among traders. Additionally, its future open interest has soared by 9.5% over the past 24 hours and 3.9% over the past four hours.

This rising open interest suggests growing trader interest in XRP, with a potential bias toward long positions over short ones, as sentiment has quickly shifted following the breakout. Combining these bullish on-chain metrics with XRP’s technical analysis, it appears that bulls are currently dominating the assets and potentially triggering a significant upside rally in the coming days.

Comments are closed, but trackbacks and pingbacks are open.